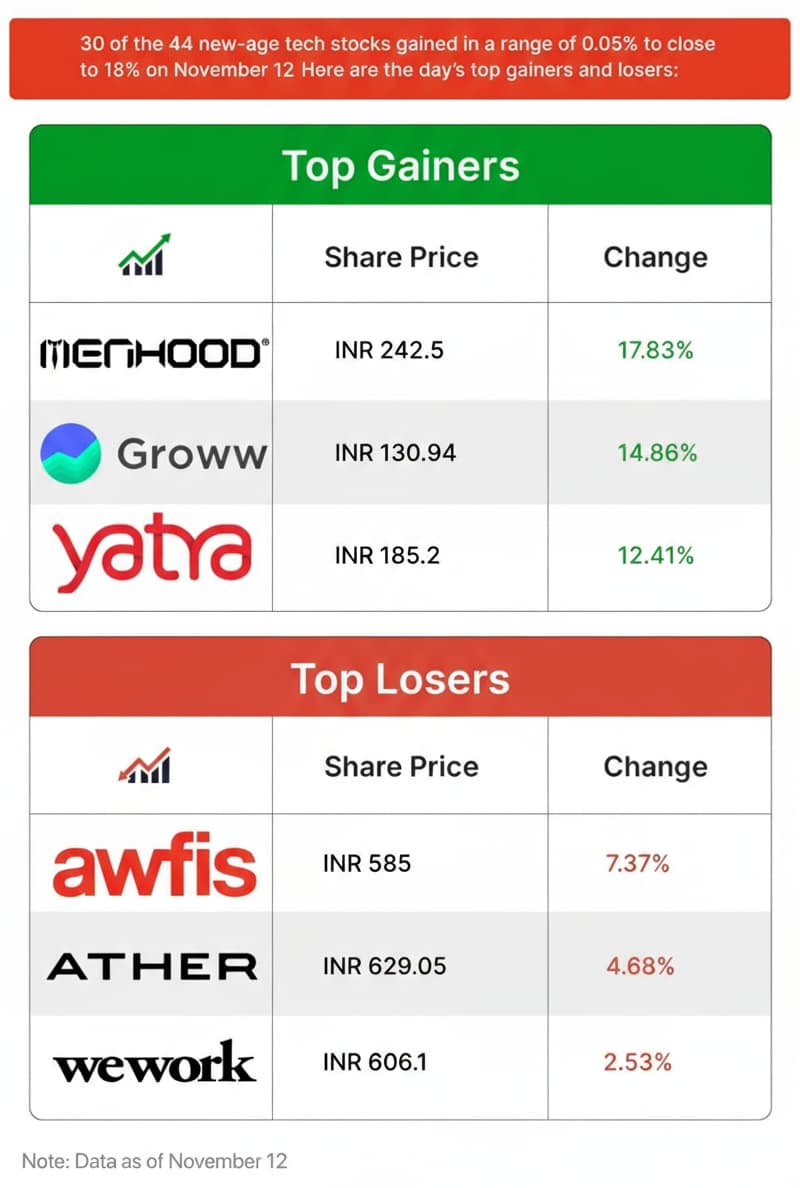

Groww has marked a blockbuster D-Street debut. After listing at a premium of 14%, the stock rallied throughout the day and closed its first trading session with a market capitalisation of INR 80,837.07 Cr (about $9.1 Bn). So, how did the markets react to Groww’s IPO?

Investors’ Verdict: After a 17.6X oversubscription for its public issue, the stock debuted on the bourses 14% above its INR 100 issue price. By the closing bell, its shares rocketed to INR 130.94, locking in a hefty 31% gain on its first trading day. In total, the company raked in INR 6,632.3 Cr from its IPO, which comprised a fresh issue of shares worth INR 1,060 Cr and an offer for sale component of INR 5,572.30 Cr.

Investors Score Big: The listing unlocked significant wealth for the startup’s early backers. While Peak XV Partners netted INR 1,582 Cr (52X returns), Y Combinator and Ribbit Capital pocketed INR 1,054 Cr and INR 656 Cr, respectively.

A Profitable Playbook: The stellar debut was backed by strong brand pull, an expanding user base and a diversified product stack. Crucially, healthy profits and expanding margins calmed investor fears about sustainable unit economics.

The Road Ahead: With the IPO euphoria behind it, Groww aims to scale sustainably and diversify beyond broking into derivatives and ETFs. With an eye on deepening services for affluent users, the company is now focussing on risk controls rather than chasing volume.

Nevertheless, the coming quarters will test the unicorn’s mettle amid SEBI’s F&O clampdown and the pressure to sustain profitable growth. While that is a story for another day, here is how Groww shone on the bourses on its debut day.

From The Editor’s Desk Pokerbaazi Drags Down Nazara’s Q2

Pokerbaazi Drags Down Nazara’s Q2 - The listed gaming company slipped into the red and posted a net loss of INR 33.9 Cr in Q2 FY26 due to an impairment loss of nearly INR 915 Cr on its investment in PokerBaazi and rising expenses.

- Despite the setbacks, Nazara showed robust growth, with a 65% YoY jump in revenue to INR 526.5 Cr. Meanwhile, total income stood at INR 1,630.9 Cr on the back of a one-time gain from Nazara reclassifying Nodwin as an associate entity.

- The ban on real money gaming forced the company to almost write off its stake in PokerBaazi. Regulatory pressure intensified as Nazara and group entities Halaplay and OpenPlay received GST notices totalling over INR 1,000 Cr.

- With India’s quick commerce boom spreading to smaller cities, Zypp plans to expand its fleet from 20,000 to 1 Lakh and enter multiple tier II cities in the next two to three years.

- Founded in 2017, Zypp offers its EV fleet to major quick commerce platforms. Not content with this, the startup is now moving beyond rentals to advertising and fleet management solutions for other operators.

- After years of aggressive scaling, it reported operational profitability in July 2025, with EBITDA margins turning positive in September. It is now projecting INR 600 Cr in revenue with full EBITDA profitability in FY26.

- The Mamaearth parent reported a net profit of INR 39.2 Cr in Q2 FY26, reversing a loss of INR 18.6 Cr in the year-ago quarter, on the back of operating revenue jumping 17% YoY to INR 538 Cr, improving margins and steady cost management.

- Honasa’s portfolio brands, including Mamaearth, The Derma Co, and BBlunt, continued to report healthy double-digit growth, while its flagship rice facewash joined the INR 100 Cr ARR club.

- Now, Honasa is also expanding into the oral care segment by acquiring a 25% stake in Couch Commerce, aiming to diversify its portfolio and capitalise on other fast-growing categories.

- The EV maker zoomed past its rival Ola Electric, both in terms of units sold and key financial metrics, in Q2 FY26 on the back of strong demand, robust distribution expansion, improving margins and a tight leash on expenses.

- Besides EV sales, Ather’s growing non-vehicle revenue contributed 12% to its total top line and is becoming a key driver for its margin expansion. Its growing charging network, battery-as-a-service and after-sales are also helping Ather monetise more effectively.

- But the road ahead will be challenging. Sustaining margins without heavy reliance on government subsidies will be critical, while intensifying competition could pressure pricing and market share.

Bombay Shaving Company Nets INR 136 Cr

Bombay Shaving Company Nets INR 136 Cr - The D2C grooming brand has raised the funds in a mix of primary and secondary deals. Led by Sixth Sense Ventures, the round also saw participation from Rahul Dravid, several family offices and HNIs.

- Bombay Shaving Company plans to double down on offline expansion as it gears up for a potential public listing soon.

- Founded in 2016, the brand started as a men’s grooming startup before expanding into perfumes, skincare, and women’s products. The company claims to have achieved profitability in FY25 but didn’t divulge exact figures.

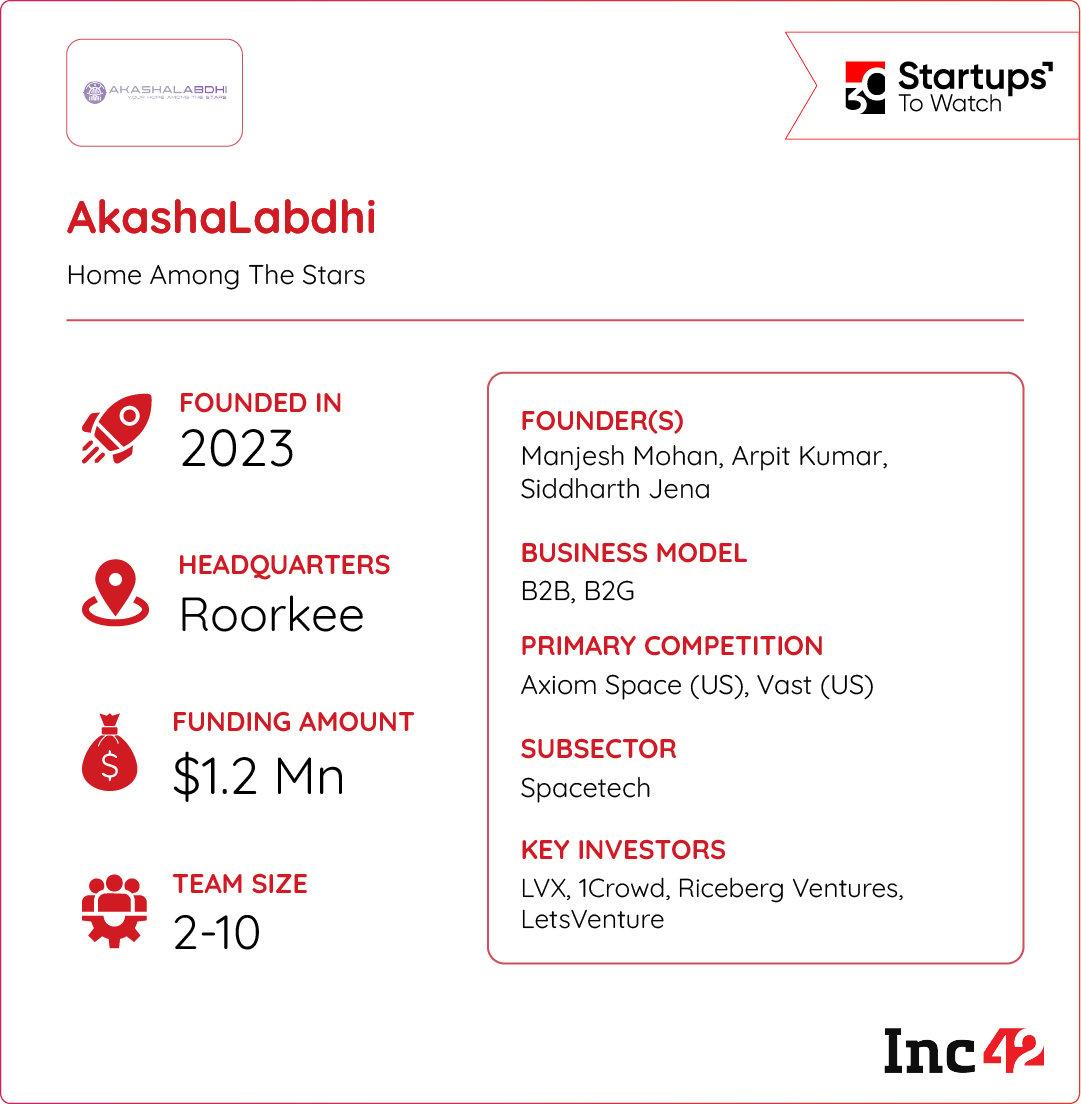

As humanity prepares for deeper space missions, a critical challenge has emerged – the shortage of scalable, affordable, and livable space infrastructure. Spacetech startup AkashaLabdhi is addressing this problem by developing expandable space habitats.

Inflatable Homes In Space: Founded in 2023, the startup is developing expandable space habitats, designed to support long-duration missions. Its flagship concept, Antariksh HAB, is an inflatable orbital habitat capable of expanding in space to accommodate six to sixteen crew members. The habitat is designed for a range of use cases, including microgravity research, orbital logistics, and space tourism.

The Cost-Effective Edge: What sets AkashaLabdhi apart is its focus on modular, compact, and cost-effective design, which enables rapid deployment and scalability in orbit. The IISc-incubated startup, which aims to carve a niche in India’s growing $44 Bn spacetech market, is eyeing the deployment of its first habitat prototype by early 2026.

Backed by its innovative tech play, can AkashaLabdhi redefine orbital infrastructure?

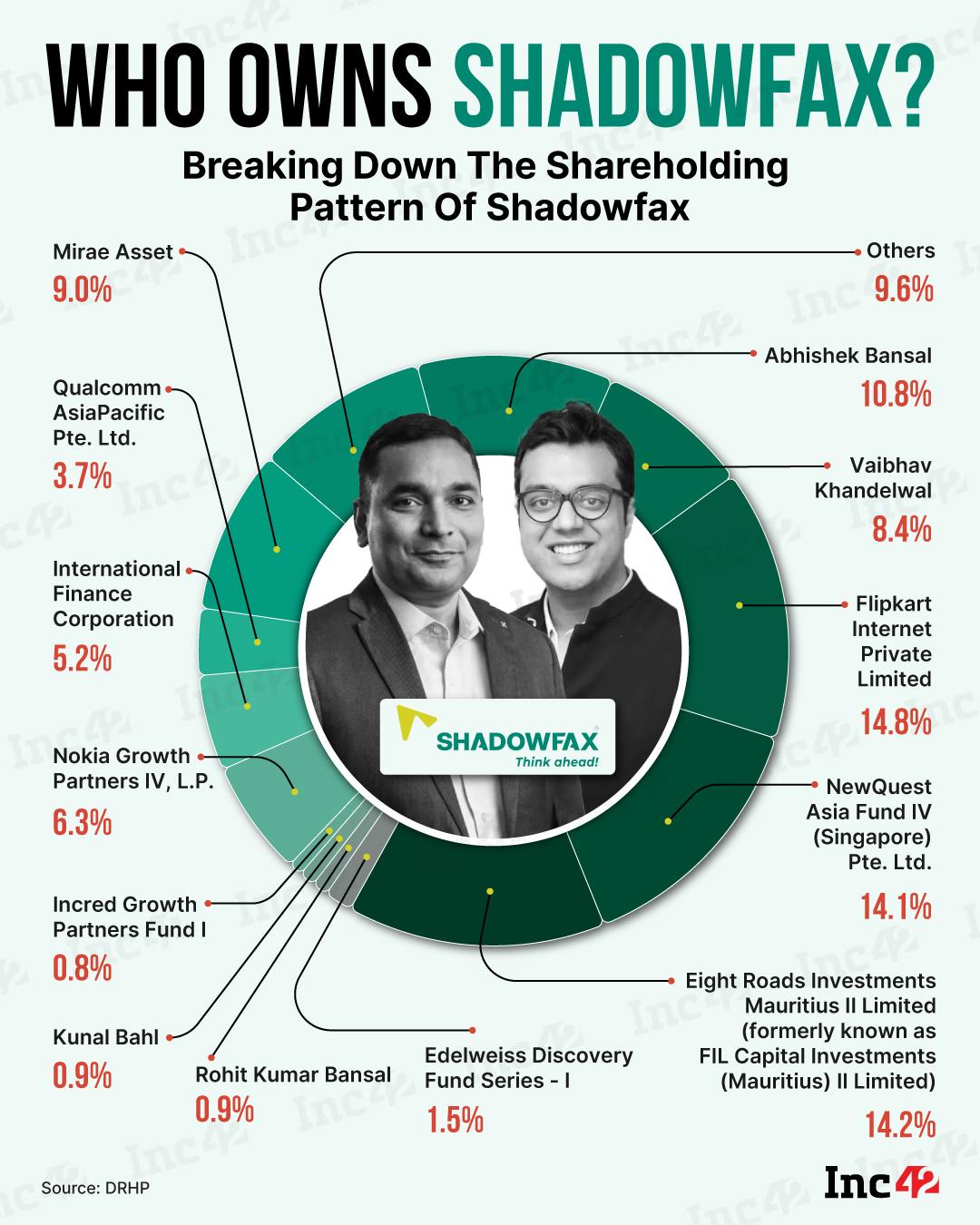

Shadowfax gears up for its INR 2,000 Cr IPO, split evenly between a fresh issue and an OFS. But who really owns the logistics giant?

The post Groww’s Stellar Debut, Pokerbaazi Hits Nazara & More appeared first on Inc42 Media.

You may also like

Multi-city deadly terror attack foiled say Investigation sources, massive amount of fertilizer for explosives procured

Thamma OTT release update: When and where to watch Rashmika Mandanna, Ayushmann Khurrana's horror comedy online

Children's Day 2025: Date, history, significance, importance of bal diwas and ways to celebrate

Weather department predicts rain in many TN districts today

Delhi Blast Declared a Terrorist Incident by Union Cabinet